Income Withholding Cases with Prorated Amounts

Lump sum payments

Employers are required to withhold income for child support obligations up to the full amount of the Maximum Withholding allowed by law. When an employee or independent contractor's obligations exceed the Maximum Withholding amount and the employee has more than one Income Withholding Order (IWO), the obligations that make up the Maximum Withholding amount must be prorated (divided) among the IWOs so that each IWO receives its share of the payment. New York State laws also require that current support obligation amounts must be paid first, then health insurance premiums, and finally arrears (past-due support obligations and other amounts), up to the amount of the Maximum Withholding.

Withholding calculations are shown for three cases where the Maximum Withholding amount must be prorated between two IWOs so that each IWO receives its share and support obligations are paid in the required order (current support, health insurance, and arrears).

Case A: Current obligation and the health insurance premium are paid in full; arrears are prorated.

Case B: Current obligation is paid in full, but the health insurance premium cannot be paid; arrears amounts are prorated.

Note: The health insurance premium must be paid in full or not at all. The premium cannot be prorated.

Case C: Current obligation amounts are prorated; the health insurance premium and arrears cannot be paid.

Case A: Current support, health insurance premium and prorated arrears

If the sum of the employee or independent contractor's total current obligations and the health insurance premium is less than the Maximum Withholding, withhold the current obligations and the health insurance premium. If there is any remainder, that amount is prorated for arrears obligations.

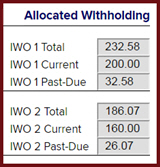

illustration of case results

For example, suppose an employee has a Maximum Withholding amount of $463.65 biweekly. This employee has two IWOs with current withholding obligations of $200 and $160 biweekly and arrears obligations of $100 and $80 biweekly. The total of the current obligations for both IWOs is $360.00 biweekly. The health insurance premium is $45.00 biweekly for a total of $405.00—less than the Maximum Withholding. Therefore, the remainder of the Maximum Withholding ($58.65) can be prorated and applied to the arrears obligation for this employee.

In New York State, the pro rata share of the arrears for each IWO is calculated as follows:

- Divide the total arrears for each IWO by the total arrears for all IWOs. For this example, the two biweekly pro rata shares are

- 100/180 = 0.555556 or 55.5556%

- 80/180 = 0.444444 or 44.4444%

- Subtract the sum of the total current obligations and the health insurance premium from the Maximum Withholding. (Note: If the result is negative, subtract the total current obligations from the Maximum Withholding.)

For the employee in our example, the difference is $58.65: $463.65 − (360 + 45) = $58.65. - Multiply the difference by the pro rata percentage for each IWO:

- 0.555556 × 58.65 = $32.58

- 0.444444 × 58.65 = $26.07

- Add the prorated arrears amounts to the current obligation amounts for the total amount for each IWO.

- Add the health insurance premium to the total amounts for all IWOs to get the total amount to withhold.

For this employee, then, the total withholding is allocated as follows:

| Biweekly Withholding with Health Insurance and Arrears Proration | ||||

|---|---|---|---|---|

| Notice | Current obligation | Arrears | Total | Health Insurance Premium |

| 1 | 200.00 | 32.58 | 232.58 | 45.00 |

| 2 | 160.00 | 26.07 | 186.07 | |

| Total | 360.00 | 58.65 | 418.65 | 45.00 |

| Total withholding (includes health insurance premium) | $463.65 | |||

| Total support to remit | $418.65 | |||

Case B: Current support and prorated arrears (No health insurance)

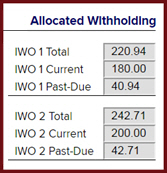

Illustration of case results

If the sum of the employee or independent contractor's total current obligations and the health insurance premium is more than the Maximum Withholding, withhold the full amount of the current obligations and prorated arrears amounts for each IWO. You cannot withhold the health insurance premium.

For example, suppose again that an employee has a Maximum Withholding of $463.65 biweekly. This employee has two IWOs, with biweekly current obligations of $180 and $200, arrears of $115 and $120, and a health insurance premium of $100. The biweekly current obligations total $380, but adding the health insurance premium of $100 totals $480—more than the Maximum Withholding. Likewise, the current and arrears obligations total $615—more than the Maximum Withholding. For this employee, the health insurance premium cannot be withheld, and the remaining $83.65 is prorated for the arrears obligation.

The pro rata share of the arrears is calculated as follows:

- Divide the total arrears for each IWO by the total arrears for all IWOs. For this example, the two biweekly pro rata shares are

- 115/235 = 0.489362 or 48.9362%

- 120/235 = 0.510638 or 51.0638%

- Subtract the sum of the total current obligations and the health insurance premium from the Maximum Withholding. (Note: If the result is negative, subtract the total current obligations from the Maximum Withholding.)

For the employee in this example, the result is negative, so you subtract the total current obligations from the Maximum Withholding. That difference is $83.65: $463.65 − 380 = $83.65. - Multiply the difference by the pro rata percentage for each IWO:

- 0.489362 × 83.65 = $40.94

- 0.510638 × 83.65 = $42.71

- Add the prorated arrears amounts to the current obligation amounts for the total amount for each IWO.

- Enter "0.00" for the health insurance premium and add the totals for each IWO to get the total amount to withhold.

The withholding is allocated as follows:

| Biweekly Withholding with Arrears Proration (No health insurance) | ||||

|---|---|---|---|---|

| Notice | Current obligation | Arrears | Total | Health Insurance Premium |

| 1 | 180.00 | 40.94 | 220.94 | 0.00 |

| 2 | 200.00 | 42.71 | 242.71 | |

| Total | 380.00 | 83.65 | 463.65 | 0.00 |

| Total withholding (without health insurance) | $463.65 | |||

| Total support to remit | $463.65 | |||

Case C: Prorated current obligations (No health insurance, no arrears)

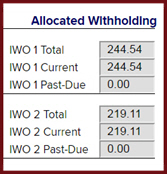

Illustration of case results

If the employee or independent contractor's total current obligations exceed the Maximum Withholding, withhold the Maximum Withholding with amounts prorated for the current obligation of each IWO. You cannot withhold the health insurance premium or any amount for arrears.

For example, suppose once more that an employee has a Maximum Withholding amount of $463.65 biweekly. This employee has two IWOs with current obligations of $250 and $224 biweekly. The current obligation total for both IWOs is thus $474.00—more than the Maximum Withholding. The current obligation amounts must be prorated for this employee.

In New York State, the pro rata share of the current obligation for each IWO is calculated as follows:

- Divide the total current obligation for each IWO by the total current obligation for all IWOs. For this example, the two pro rata shares are

- 250/474 = 0.527462 or 52.7462%

- 224/474 = 0.472574 or 47.2574%

- Multiply the Maximum Withholding amount by the pro rata percentage for each IWO:

- 0.527461 × 463.65 = $244.54

- 0.472574 × 463.65 = $219.11

- Enter "0.00" for the health insurance premium and add the total current obligation amount for each IWO to get the total amount to withhold.

The table below shows the proration for this example:

| Biweekly Withholding with Prorated Current Obligation Amounts | ||||

|---|---|---|---|---|

| Notice | Current obligation | Arrears | Total | Health Insurance Premium |

| 1 | 244.54 | 0.00 | 244.54 | 0.00 |

| 2 | 219.11 | 0.00 | 219.11 | |

| Total | 463.65 | 0.00 | 463.65 | 0.00 |

| Total withholding (without health insurance) | $463.65 | |||

| Total support to remit | $463.65 | |||